CNQ Stock: A Comprehensive Guide to Making Investment Decisions

Investment Analysis and Portfolio Management Course (with Excel®) - Source www.ferventlearning.com

Editor's Notes: CNQ Stock: Comprehensive Overview and Investment Analysis guide for [Today's Date].

Investing in the stock market can be a great way to grow your wealth over time. However, it's important to do your research before you invest in any stock. One stock that you may want to consider is CNQ Stock. In this guide, we will provide you with a comprehensive overview of CNQ Stock. We will also provide you with some tips on how to invest in CNQ Stock.

| Key Differences | CNQ Stock |

|---|---|

| Industry | Energy |

| Ticker Symbol | CNQ |

| Market Cap | \$15.5 billion |

| Dividend Yield | 4.2% |

FAQ

This section provides answers to frequently asked questions about CNQ stock, facilitating a deeper understanding of the company's performance and investment potential.

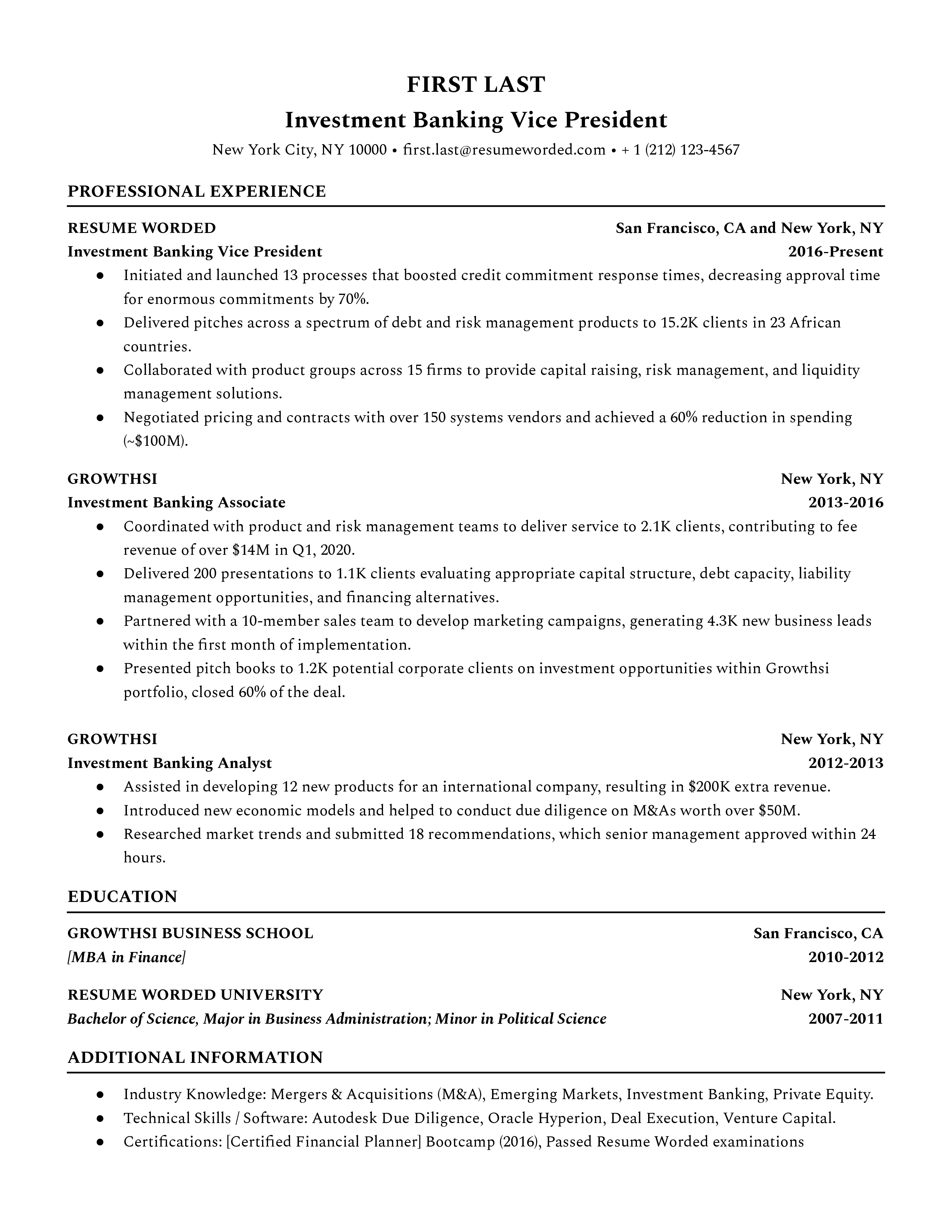

Investment Banking Vice President CV Example for 2023 | Resume Worded - Source resumeworded.com

Question 1: What is the current stock price of CNQ?

The current stock price of CNQ can be found on financial news websites or through a broker.

Question 2: What is the dividend yield of CNQ?

The dividend yield of CNQ can vary over time. Interested investors should refer to the company's financial statements or consult with a financial advisor for the most up-to-date information.

Question 3: What are the key financial metrics of CNQ?

Key financial metrics include revenue, earnings, cash flow, and debt. These metrics can be found in the company's financial statements or on financial data websites.

Question 4: What are the growth prospects of CNQ?

The growth prospects of CNQ depend on various factors, such as industry trends, economic conditions, and the company's execution of its strategies. Analysts' reports and the company's financial projections can provide insights into its future prospects.

Question 5: What are the risks associated with investing in CNQ?

Investing in any stock involves risks. Some potential risks associated with CNQ include commodity price volatility, competition, and geopolitical uncertainty.

Question 6: How do I buy CNQ stock?

To purchase CNQ stock, open an account with a broker and place an order to buy the desired number of shares.

This FAQ section provides a comprehensive overview of common questions about CNQ stock. However, it is essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

Moving on, the following section explores the investment analysis of CNQ stock, offering valuable insights into its valuation and potential for investors.

Tips

CNQ Stock: Comprehensive Overview And Investment Analysis presents insights and tips to help investors make informed decisions, based on a thorough analysis of Canadian Natural Resources Limited (CNQ). Here are some essential tips to consider:

Tip 1: Evaluate Financial Health: Assess CNQ's financial statements to understand its revenue, profitability, debt, and cash flow. Strong financials indicate a healthy company with the potential for long-term growth.

Tip 2: Analyze Industry Landscape: Study the energy sector, particularly oil and gas exploration and production. Understand market trends, competition, and the regulatory environment to gauge CNQ's competitive advantage.

Tip 3: Consider Management and Operations: Research CNQ's management team, their experience, and their strategic vision. Assess the company's operations, including production targets, exploration success rates, and environmental practices.

Tip 4: Assess Valuation and Growth Potential: Use financial ratios, such as price-to-earnings (P/E) and price-to-book (P/B), to compare CNQ's valuation to peers. Project future earnings and growth based on historical data and industry outlook.

Tip 5: Monitor Current Events and News: Keep abreast of relevant news articles, company announcements, and industry reports that can impact CNQ's stock price. Timely information can provide valuable insights for investment decisions.

By following these tips, investors can gain a deeper understanding of CNQ and make more informed investment choices.

Summary: In-depth research and thoughtful analysis are key to successful investing in CNQ or any other company. By considering these tips, investors can navigate the market with greater confidence and make informed decisions to maximize their returns.

CNQ Stock: Comprehensive Overview And Investment Analysis

The term "CNQ Stock" encompasses a multifaceted array of aspects that warrant thorough examination and investment analysis. These include the company's financial performance, industry dynamics, growth potential, and valuation metrics.

- Financial Performance: CNQ's revenue, profitability, and cash flow provide insights into its financial health.

- Industry Dynamics: Understanding the competitive landscape and market trends is essential for assessing CNQ's industry position.

- Growth Potential: CNQ's business strategy, product pipeline, and market expansion plans indicate its future growth prospects.

- Valuation Metrics: Key metrics like price-to-earnings, price-to-sales, and dividend yield help determine the stock's fair value.

- Investment Analysis: A comprehensive analysis considers all these aspects to inform investment decisions regarding CNQ stock.

- Risk Factors: Identifying and assessing potential risks, such as commodity price fluctuations and regulatory changes, is crucial for risk management.

Long CNQ: Stock Shows Reversal Pattern on High Volumes, Targeting June - Source invezz.com

These key aspects are interconnected. For example, strong financial performance can drive share price appreciation, while favorable industry dynamics can enhance growth potential. A balanced assessment of all these factors is essential for making informed investment decisions regarding CNQ stock.

CNQ Stock: Comprehensive Overview And Investment Analysis

A Comprehensive Overview And Investment Analysis of CNQ Stock provides valuable insights into the company's financial performance, industry position, and potential investment opportunities. It assesses the company's strengths, weaknesses, and opportunities to determine its attractiveness as an investment.

Cnq Stock Illustrations – 12 Cnq Stock Illustrations, Vectors & Clipart - Source www.dreamstime.com

This analysis is crucial for investors seeking to make informed investment decisions. It allows them to understand the company's business model, financial health, and competitive landscape. By considering these factors, investors can assess the potential risks and rewards associated with investing in CNQ stock and make informed decisions that align with their investment goals.

This understanding provides a solid foundation for investors to make well-informed investment decisions. It enables them to evaluate the company's prospects for growth, profitability, and sustainability. By utilizing this information, investors can optimize their investment portfolios and potentially maximize their returns on investment.

| Factor | Significance |

|---|---|

| Financial Performance: | Provides investors with insights into the company's revenue, profitability, and cash flow. |

| Industry Position: | Assesses the company's competitive advantage, market share, and industry trends. |

| Investment Opportunities: | Identifies potential investment opportunities based on the company's growth prospects and valuation. |

Conclusion

The Comprehensive Overview And Investment Analysis of CNQ Stock presents a detailed assessment of the company's financial performance, industry position, and investment potential. Investors can utilize this information to make well-informed investment decisions that align with their risk tolerance and investment goals.

Understanding the company's strengths, weaknesses, and opportunities provides investors with a solid foundation to evaluate the company's future prospects and make strategic investment decisions. By incorporating this analysis into their investment strategy, investors can potentially enhance their portfolio performance and achieve their financial objectives.