Pensión Garantizada Universal: requisitos para solicitarla vía web - Source lahora.cl

Después de analizar las políticas, recopilar información y esforzarnos por comprender este nuevo beneficio, hemos compilado esta guía de Pensión Garantizada Universal para ayudar a los lectores a tomar decisiones informadas.

| Característica | Detalles |

|---|---|

| Monto | Hasta $1,200 por mes para personas solteras y $1,800 por mes para parejas casadas |

| Requisitos de Elegibilidad | 65 años o más, ingresos bajos y residencia en los EE. UU. durante al menos 10 años |

| Cómo Solicitar | A través del Seguro Social o completando una solicitud en línea |

FAQ

This FAQ section provides detailed answers to frequently asked questions regarding the Universal Guaranteed Pension, including its eligibility requirements, application process, and financial benefits.

Question 1: Who is eligible for the Universal Guaranteed Pension?

To qualify for the Universal Guaranteed Pension, individuals must meet specific age and residency requirements. Applicants must have reached the established retirement age, which varies depending on the country or jurisdiction, and must have resided in the relevant jurisdiction for a certain period of time.

Question 2: What is the amount of the Universal Guaranteed Pension?

The amount of the Universal Guaranteed Pension is typically determined by the government or administering authority and can vary depending on factors such as the cost of living, economic conditions, and the individual's contribution history. In some cases, the pension amount may be subject to income or asset limits.

Question 3: How do I apply for the Universal Guaranteed Pension?

The application process for the Universal Guaranteed Pension usually involves submitting an application form to the relevant government agency or pension fund. The form typically requires personal information, proof of identity, and evidence of eligibility, such as proof of age and residency. Applicants may also need to provide financial information or documentation of their income and assets.

Question 4: When will I start receiving the Universal Guaranteed Pension?

The commencement date for receiving the Universal Guaranteed Pension depends on the specific rules and regulations governing the program. In most cases, individuals become eligible to receive the pension after reaching the established retirement age and meeting the residency requirements. The pension is typically paid on a monthly or annual basis.

Question 5: Can I receive the Universal Guaranteed Pension while working?

The eligibility for receiving the Universal Guaranteed Pension while working varies depending on the regulations of the specific program. In some cases, individuals may be able to receive a partial pension while continuing to work, while in other cases, they may be required to retire fully in order to qualify for the full pension.

Question 6: Is the Universal Guaranteed Pension taxable?

The tax treatment of the Universal Guaranteed Pension is determined by the laws and regulations of the applicable jurisdiction. In some cases, the pension may be subject to income tax, while in other cases it may be exempt from taxation. Individuals should consult with tax professionals or the relevant government agencies to determine the tax implications in their specific situation.

Tips For Applying for Universal Basic Income:

The Guaranteed Universal Pension is a benefit that provides a basic income to low-income individuals. Pensión Garantizada Universal: Monto, Requisitos Y Cómo Solicitarla If you are eligible, you can apply for this benefit to help you make ends meet.

Tip 1: Make Sure You Meet The Eligibility Requirements.

To be eligible for the Guaranteed Universal Pension, you must be a resident of the state of Chile, be at least 65 years old, and have a low income.

Seremi del Trabajo y Previsión Social informó reajuste de la Pensión - Source www.chanarcillo.cl

You can check the government's website to see if you meet the eligibility requirements.

Tip 2: Compiling Necessary Documentation.

When you apply for the Guaranteed Universal Pension, you will need to provide documentation to prove your identity and income. This documentation may include your birth certificate, social security card, and pay stubs.

Tip 3: Apply On Time.

The deadline to apply for the Guaranteed Universal Pension is December 31st of each year. If you miss the deadline, you will have to wait until the next year to apply.

Tip 4: Apply Online Or By Mail.

You can apply for the Guaranteed Universal Pension online or by mail. If you apply online, you will need to create an account on the government's website. If you apply by mail, you can download the application form from the government's website.

Tip 5: Be Patient.

It may take several weeks or months for your application to be processed. Once your application is processed, you will be notified by mail. If you are approved for benefits, you will begin receiving payments within a few weeks.

Pensión Garantizada Universal: Monto, Requisitos Y Cómo Solicitarla

The Pensión Garantizada Universal (PGU) is a social benefit in Chile that aims to provide a minimum pension to elderly citizens. It is essential to understand its amount, eligibility requirements, and application process to ensure access to this vital support.

- Monto: The PGU provides a monthly payment to eligible individuals.

- Requisitos: To qualify for the PGU, individuals must meet specific age, income, and residency requirements.

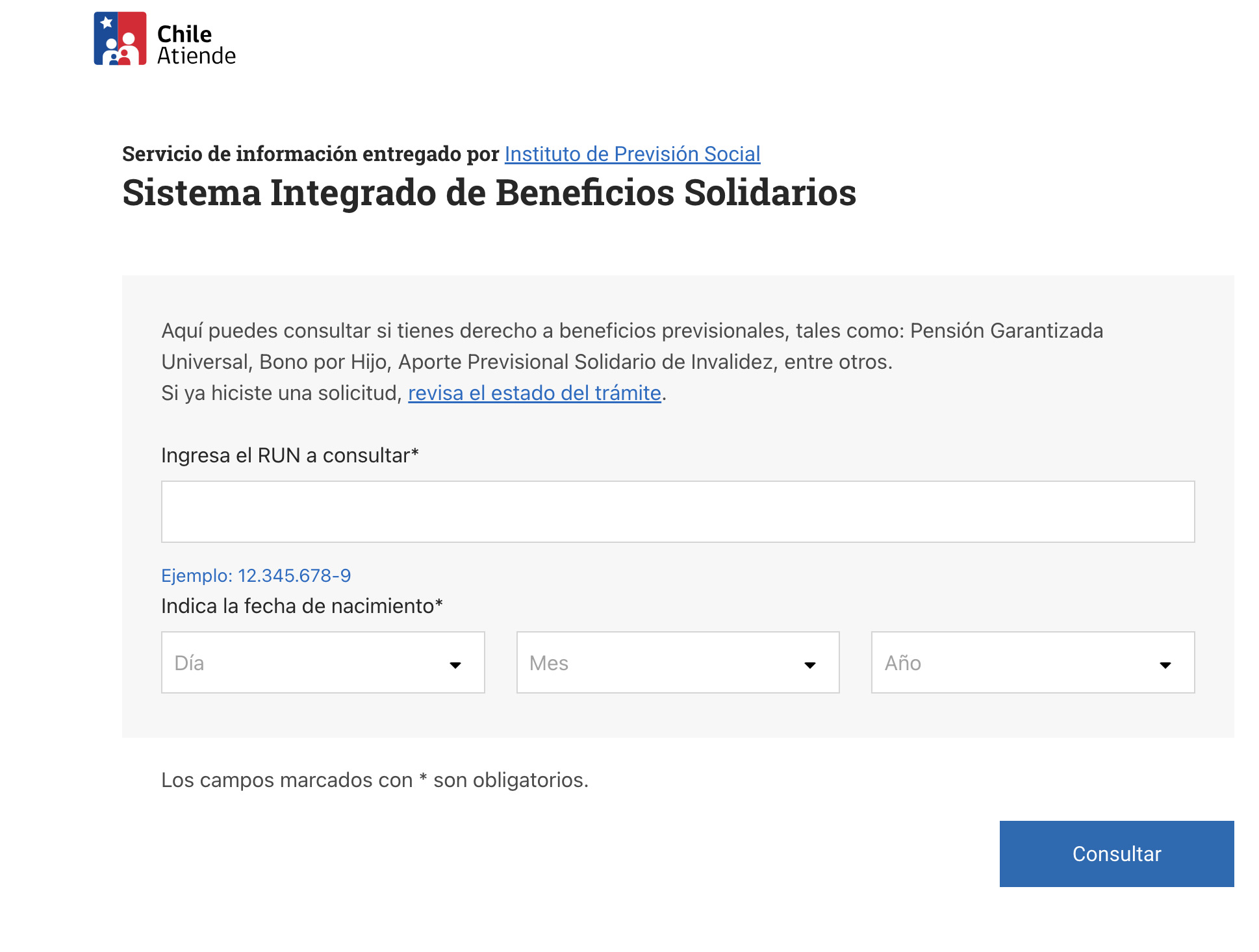

- Cómo Solicitarla: The PGU can be applied for through the Institute of Social Security (IPS).

- Beneficios: The PGU supplements existing pension benefits, ensuring a minimum level of financial security.

- Impacto Social: The PGU plays a crucial role in reducing poverty and improving the well-being of elderly citizens.

- Contribuciones: The PGU is funded through general tax revenues, demonstrating the government's commitment to supporting its elderly population.

The PGU is a multifaceted program that addresses the financial needs of elderly citizens in Chile. By understanding its key aspects, individuals can ensure access to this essential support, promoting dignity, security, and well-being in their later years.

Pensión Garantizada Universal ¿Cuáles serán los nuevos requisitos para - Source redgol.cl

Pensión Garantizada Universal: Monto, Requisitos Y Cómo Solicitarla

The Pensión Garantizada Universal (PGU) is a social benefit that provides a minimum guaranteed pension to elderly people in Chile. It is a non-contributory benefit, meaning that it is not based on previous contributions to the social security system. To be eligible for the PGU, individuals must meet certain requirements, such as being over the age of 65 and having a low income. The amount of the PGU is determined by the individual's income and other factors.

Desde el 1 de febrero: Conoce quiénes recibirán el nuevo monto de la - Source www.mega.cl

The PGU is an important component of the Chilean social security system, as it helps to ensure that elderly people have a minimum level of income. It is also a key part of the government's efforts to reduce poverty and inequality among older adults. The PGU has been shown to have a positive impact on the well-being of elderly people, as it helps to reduce their financial insecurity and improve their quality of life.

However, there are some challenges associated with the PGU. One challenge is that it is a relatively expensive program, and the government has had to make cuts to the benefit in recent years. Another challenge is that the PGU is not always sufficient to meet the needs of elderly people, especially those with high housing costs or other expenses. Despite these challenges, the PGU remains an important part of the Chilean social security system, and it is likely to continue to play a key role in ensuring that elderly people have a minimum level of income.

Additional Information

| Requirement | Description |

|---|---|

| Age | Must be over the age of 65 |

| Income | Must have a low income |

| Residency | Must have lived in Chile for at least 20 years |

| Nationality | Must be a Chilean citizen or permanent resident |

Conclusion

The Pensión Garantizada Universal (PGU) is an important social benefit that provides a minimum guaranteed pension to elderly people in Chile. It is a non-contributory benefit, meaning that it is not based on previous contributions to the social security system. To be eligible for the PGU, individuals must meet certain requirements, such as being over the age of 65 and having a low income. The amount of the PGU is determined by the individual's income and other factors.

The PGU is an important component of the Chilean social security system, as it helps to ensure that elderly people have a minimum level of income. It is also a key part of the government's efforts to reduce poverty and inequality among older adults. The PGU has been shown to have a positive impact on the well-being of elderly people, as it helps to reduce their financial insecurity and improve their quality of life.

However, there are some challenges associated with the PGU. One challenge is that it is a relatively expensive program, and the government has had to make cuts to the benefit in recent years. Another challenge is that the PGU is not always sufficient to meet the needs of elderly people, especially those with high housing costs or other expenses. Despite these challenges, the PGU remains an important part of the Chilean social security system, and it is likely to continue to play a key role in ensuring that elderly people have a minimum level of income.