After thorough analysis and research, our team has meticulously crafted this comprehensive guide to help you navigate the complexities of the Reforma De Pensiones PGU. Our goal is to empower you with the knowledge and insights necessary to make informed decisions about your pension and safeguard your financial well-being in retirement.

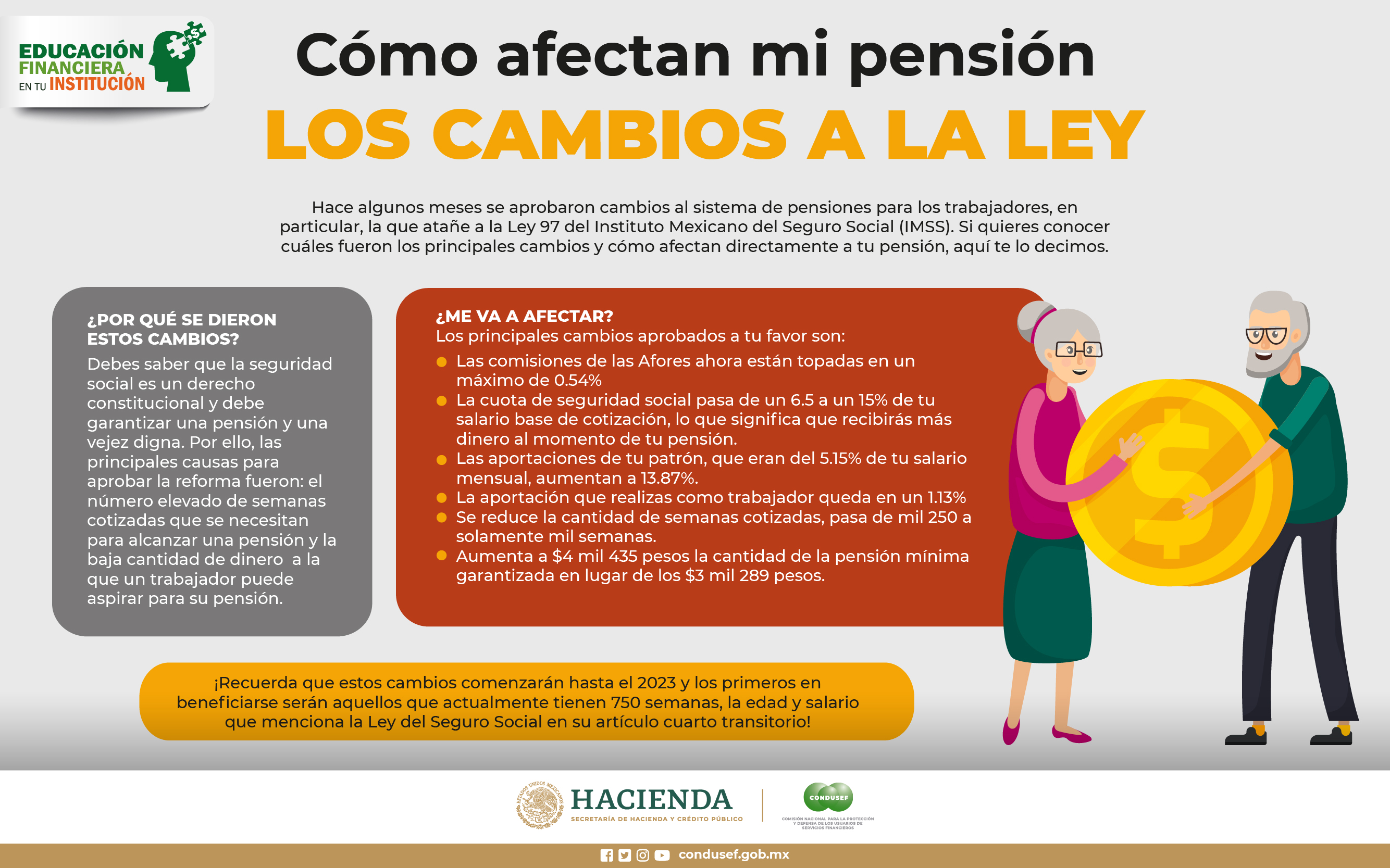

Vive FISSEP | Conoce los cambios a la ley sobre las pensiones - Source vivefissep.mx

| Fixed retirement age | Gradual increase in retirement age |

| Mandatory pension contributions | Increased contribution rates for higher-income earners |

| Limited pension benefits | Expanded coverage and improved benefits for low-income earners |

- Explanation of the specific changes introduced by the Reforma De Pensiones PGU

- Analysis of the impact of these changes on different segments of the population

- Guidance on how to prepare for the changes and maximize pension benefits

FAQ

This FAQ section provides answers to frequently asked questions about the recent pension reform, known as the "Pension Guarantee Unit (PGU)". The PGU aims to enhance the sustainability and fairness of the pension system while ensuring that retirees receive adequate income support.

Aumento al salario mínimo y su impacto en el bolsillo de los mexicanos - Source www.elsiglodedurango.com.mx

Question 1: What is the Pension Guarantee Unit (PGU)?

The PGU is a new unit of account used to calculate and adjust pension benefits. It replaces the previously used Unidad de Fomento (UF), which was linked to inflation.

Question 2: How does the PGU affect current pensioners?

Current pensioners will see a gradual adjustment in their pension benefits based on the PGU. The adjustment will consider factors such as age, years of contribution, and average income during their working years.

Question 3: How will the PGU impact future pensioners?

Future pensioners will have their pensions calculated and adjusted using the PGU. The PGU is expected to provide a more stable and predictable pension income over time, protected from inflation.

Question 4: What are the key benefits of the PGU?

The PGU aims to enhance the sustainability of the pension system by linking benefits to a more stable economic indicator. It also aims to improve the fairness and adequacy of pension benefits by considering individual factors.

Question 5: What are the potential drawbacks of the PGU?

One potential drawback is that the PGU may lead to lower pension benefits for some individuals compared to the previous system. However, the government has implemented measures to mitigate this impact.

Question 6: What is the overall impact of the PGU on the pension system?

The PGU is expected to strengthen the long-term viability of the pension system while ensuring that retirees receive adequate income support. It represents a significant step towards modernizing and improving the pension system.

In summary, the PGU is a major reform that aims to improve the sustainability and adequacy of pension benefits while protecting them from inflation. It is part of a broader effort to ensure that future generations of retirees have access to secure and reliable income support.

Tips for Understanding the PGU Pension Reform: Its Changes and Impact

The Reforma De Pensiones PGU: Entendiendo Los Cambios Y Su Impacto En Las Pensiones introduces significant changes to the pension system in Chile, with the aim of improving the retirement benefits of citizens. Here are some key tips to help you understand the changes and their impact on your pension:

Tip 1: Know the Basic Concepts

Familiarize yourself with the fundamental concepts of the new system, such as the Guaranteed Minimum Pension (PGU), the Pension Contribution Surcharge (APC), and the Pension System Solidarity Fund (FSP). Understanding these terms will help you grasp the overall framework of the reform.

Tip 2: Calculate Your Potential Pension

Utilize the online calculators provided by the government or pension institutions to estimate your potential pension under the new system. This will give you a personalized assessment of how the changes may affect your retirement income.

Tip 3: Consider Your Retirement Age

The reform gradually increases the retirement age for both men and women. Determine how these changes will impact your retirement plans and consider any adjustments you may need to make.

Tip 4: Understand the Tax Implications

The reform introduces changes to the taxation of pensions. Be aware of these changes and assess how they may affect the net amount of your retirement income.

Tip 5: Seek Professional Advice

If you have complex retirement planning needs or require personalized guidance, consider consulting with a financial advisor or pension expert. They can help you navigate the changes and make informed decisions that optimize your retirement savings.

By following these tips, you can gain a comprehensive understanding of the PGU Pension Reform and its potential impact on your retirement future. This knowledge will empower you to make informed decisions and plan effectively for your financial well-being in the years to come.

Reforma De Pensiones PGU: Understanding the Changes and their Impact on Pensions

The Reforma De Pensiones PGU (Pension Reform) in Chile is a complex set of changes that will significantly impact pensions for current and future retirees. To fully understand these changes, it's crucial to grasp the key aspects involved, which explore various dimensions of the reform. These aspects encompass legal considerations, financial implications, social impact, and administrative changes, among others.

- Legal Framework: Establishes the new legal parameters governing pension calculations, eligibility, and other provisions.

- Contribution Structure: Alters how contributions are made to pension funds, affecting individuals' future benefits.

- Retirement Age: Introduces gradual increases in the retirement age for both men and women.

- Investment Options: Broadens the range of investment options available to pension fund managers, potentially influencing returns.

- Benefit Calculations: Revises the formulas used to calculate pension benefits based on contributions and other factors.

- Administrative Efficiency: Aims to improve the efficiency of pension fund administration, reducing costs and improving transparency.

Understanding these key aspects is essential for stakeholders to evaluate the potential impact of the Reforma De Pensiones PGU on their retirement plans. The changes may have implications for individuals' retirement income, financial planning, and overall retirement security. It's recommended to seek professional guidance and stay informed about the latest developments to make informed decisions regarding pension planning.

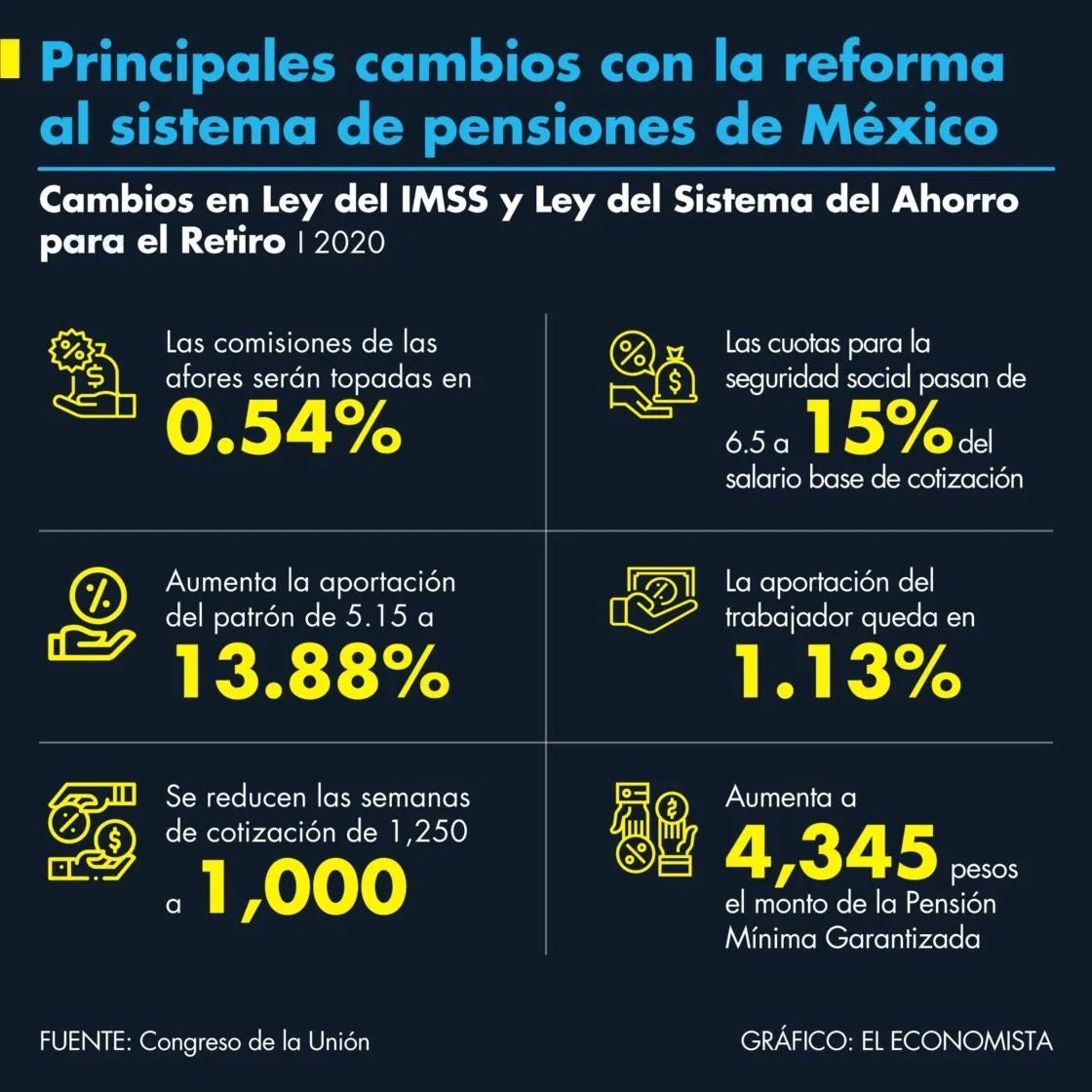

Estos son los principales cambios con la reforma al sistema de - Source www.larepublica.co

Reforma De Pensiones PGU: Entendiendo Los Cambios Y Su Impacto En Las Pensiones

The Reforma De Pensiones PGU, or Pension Reform Law, is a significant change to the pension system in Peru that was implemented in 2019. The law aims to improve the sustainability of the pension system and ensure that all Peruvians have access to a decent pension in retirement. The changes introduced by the law include increasing the retirement age, reducing the maximum pension amount, and introducing a new minimum pension guarantee.

Pensiones: estudio que encargó el gobierno asegura que mediana de tasa - Source vnexplorer.net

The Reforma De Pensiones PGU has had a significant impact on the pension system in Peru. The increase in the retirement age has meant that people are working longer before they can retire, and the reduction in the maximum pension amount has meant that people are receiving lower pensions in retirement. However, the new minimum pension guarantee has ensured that all Peruvians have access to a basic level of pension in retirement.

The Reforma De Pensiones PGU is a complex law with a number of different components. It is important to understand the changes introduced by the law in order to make informed decisions about your retirement planning.

| Component | Description |

|---|---|

| Increase in retirement age | The retirement age has been increased from 65 to 67 for men and from 60 to 62 for women. |

| Reduction in maximum pension amount | The maximum pension amount has been reduced from 80% to 70% of the average salary of the last 10 years of work. |

| Introduction of a new minimum pension guarantee | A new minimum pension guarantee has been introduced, which ensures that all Peruvians have access to a basic level of pension in retirement. |

Conclusion

The Reforma De Pensiones PGU is a significant change to the pension system in Peru. The law aims to improve the sustainability of the pension system and ensure that all Peruvians have access to a decent pension in retirement. The changes introduced by the law have had a significant impact on the pension system in Peru, and it is important to understand these changes in order to make informed decisions about your retirement planning.

The Reforma De Pensiones PGU is a complex law with a number of different components. It is important to seek professional advice to fully understand the law and its implications for your individual circumstances.